For many years, workers took into account retirement at age 60 when making financial and career plans. However, the country’s retirement standards are undergoing a complete overhaul due to factors like economic shifts and people living longer.

The Reasons Behind South Africa’s Retirement Age Increase

The fact that South Africans now live longer on average than they did in previous generations is the main cause of the shift. Although this is beneficial, it also puts strain on pension systems, which must continue to pay retirees for many years to come. Because workers would have more years to contribute to their retirement savings, longer working lives would make pension systems financially viable. The decision was also impacted by rising health care costs, which raised the need for public funds.

The Significance of the New Retirement Regulations

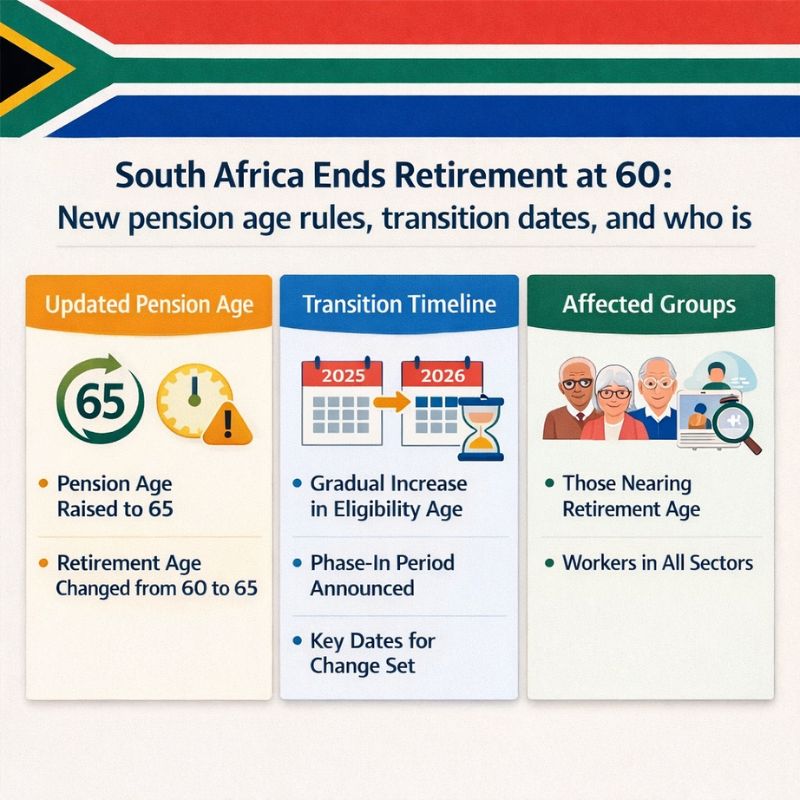

Most sectors will eliminate the default retirement age of 60 in 2026. Subject to employment contracts and pension fund regulations, the customary retirement age is being shifted closer to 65. The retirement benefits are typically lower for early retirement, even though some employees may still wish to do so. Retiring too soon can result in a significant decrease in monthly income because pension payments are adjusted to account for longer payment periods.

Effects on Employees and Workers

Employees who are getting close to retirement will need to reconsider their plan. The ones, who had planned to retire at 60, will have to stay in the workforce for a couple of more years to be able to get the full pension benefits. The good thing is that working longer gives a chance to individuals to add up their retirement savings and also lowers the risk of their income being outlived. However, it demands a lot in terms of adjusting one’s career, considering one’s health and planning one’s finances in the long run.

Differences Between Public And Private Sector

The two sectors are affected differently by the change in the retirement age. It is the public sector where most pension funds are gradually adopting the new age limit, while the private sector is still allowing the old age limit depending on the employer and fund rules. So, employees are advised to take a look at their pension fund papers and employment contracts to see how the changes impact them.