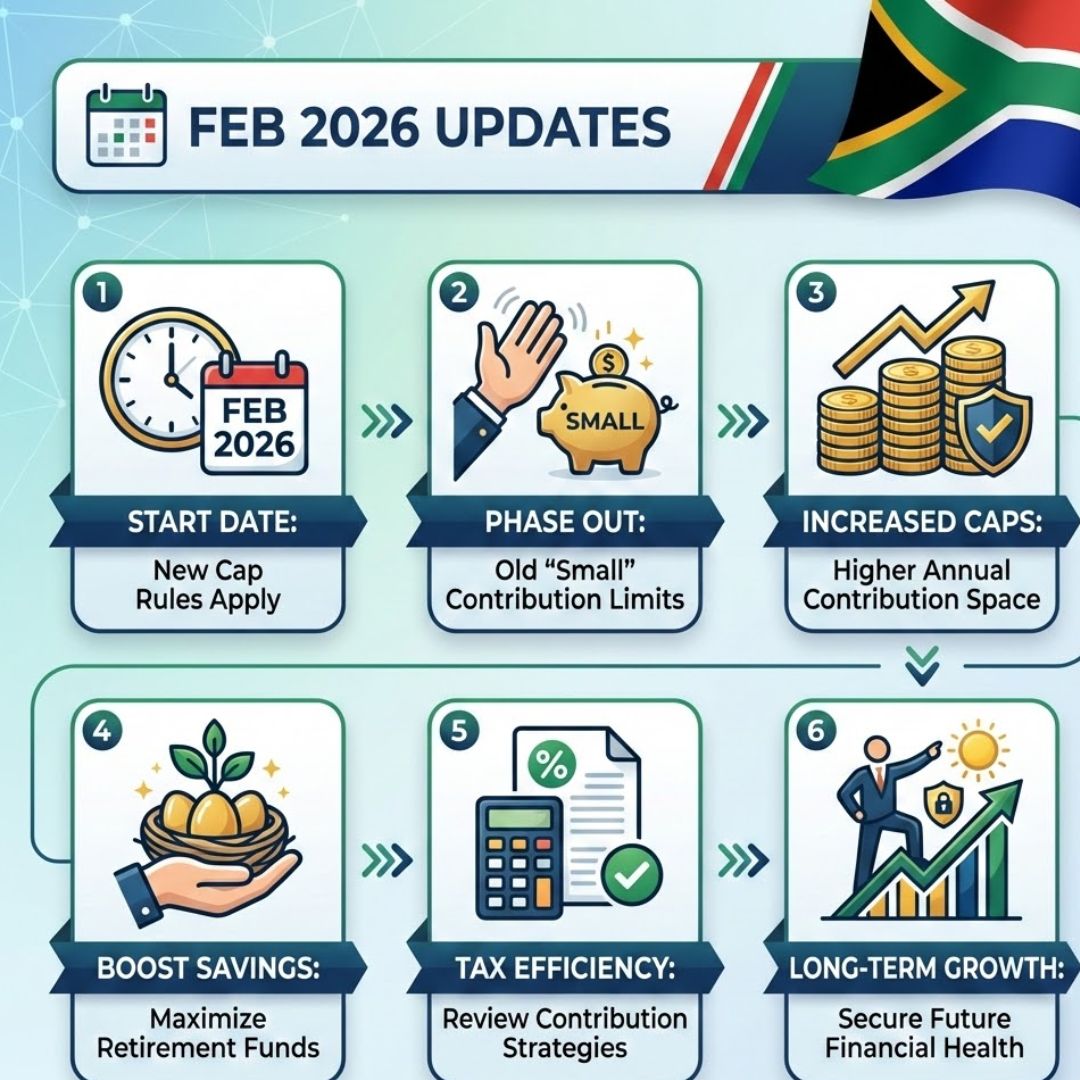

The South African government is introducing new contribution caps for superannuation starting in February 2026. These updated regulations will significantly impact workers’ retirement savings plans, particularly those who contribute small amounts. The aim is to ensure more efficient and equitable savings for the country’s future retirees. In this article, we’ll explore what these changes mean for you and how to prepare for them.

Goodbye to Small Super Contributions: What Are the New Caps?

The South African government is implementing new contribution caps that will limit the amount individuals can contribute to their superannuation accounts each year. These changes come as part of an effort to streamline pension systems and encourage higher savings rates for retirement. If you’ve been contributing small amounts to your super, you will need to review your contribution strategy to ensure you don’t exceed the new caps. Understanding the rules around contribution limits is essential to avoid unnecessary penalties.

Impact of New Contribution Limits on Retirement Savings

The new contribution caps could have a substantial impact on how much you can save for retirement. If you’re a high contributor, the new rules might limit your ability to build wealth quickly, but they aim to benefit the overall retirement security system in South Africa. While the changes may seem restrictive, they also help distribute pension benefits more fairly, preventing disproportionately high contributions from benefiting the wealthy. It’s crucial to plan ahead and adjust your investment strategy accordingly to ensure that your retirement goals remain achievable.

How to Prepare for the Contribution Cap Changes

Preparing for the new contribution caps requires careful planning. Start by reviewing your current superannuation contributions and assessing how they will be affected by the changes. If necessary, you can adjust your contributions to stay within the new limits. It’s also important to consult a financial advisor to ensure that your retirement savings are optimized under the updated rules. Additionally, consider increasing your savings in other investment vehicles to offset the impact of these contribution limits on your retirement fund.

Summary of the New Contribution Caps

The new superannuation contribution caps starting February 2026 will affect many South African workers, particularly those making small contributions. These changes are intended to ensure a more sustainable and equitable retirement system. Workers will need to adjust their contribution strategies to stay within the new limits and maximize their retirement savings potential.

| Contribution Type | Old Cap (R) | New Cap (R) | Effective Date |

|---|---|---|---|

| Individual Contributions | R150,000 | R130,000 | Feb 2026 |

| Employer Contributions | R180,000 | R160,000 | Feb 2026 |

| Combined Contributions | R330,000 | R290,000 | Feb 2026 |

| Contribution Penalties | Varies | Increased for Exceeding | Feb 2026 |

Frequently Asked Questions (FAQs)

1. What is the eligibility for the new contribution caps?

All South African workers contributing to a superannuation fund will be subject to the new caps.

SASSA February 2026 Payment Update: R560 and R1,250 grants paid on 27 February with tracking tips

SASSA February 2026 Payment Update: R560 and R1,250 grants paid on 27 February with tracking tips

2. How do the new caps affect my retirement savings?

The caps limit the total amount you can contribute each year, potentially reducing your retirement fund growth.

3. Can I exceed the new contribution limits?

Exceeding the limits will result in penalties, so it’s important to stay within the caps.

4. Should I adjust my contribution strategy?

Yes, review your contributions and consider adjusting them to stay within the new limits and maximize savings.